What is an SBA 504 loan?

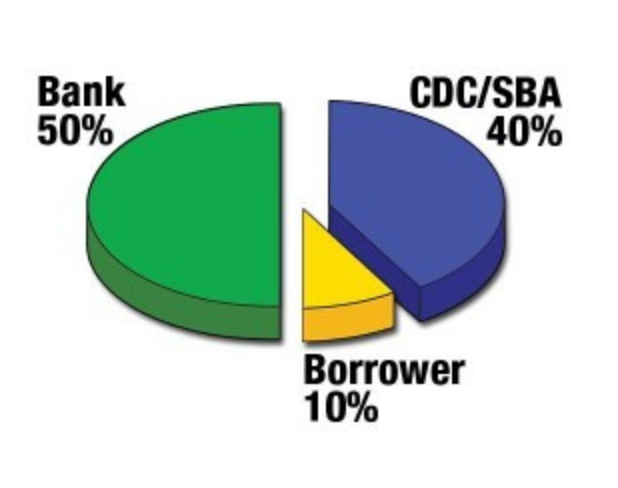

A powerful tool for small businesses looking to purchase or refinance fixed assets, the 504 Loan Program offers long-term, fixed-rate financing of real estate or machinery and equipment. To finance your project, MCDC partners with a commercial lender, which funds 50 percent or more of the loan. MCDC funds up to 40 percent of the loan and the borrower covers the rest with a down payment of at least 10 percent.

The SBA 504 loan can be for 10, 20 or 25 years. It’s fully amortized with no balloon payment. In addition, the interest rate is fixed for the life of your SBA loan. Interest rates are typically lower than the lender’s interest rate.

Project sizes range from $250,000 to $20 million.

The SBA loan participation is capped at $5 million unless it’s manufacturing or the building meets the energy efficiency requirements, then it’s $5.5 million.

Owner-occupancy = the borrower’s business must occupy at least 51% of the rentable square footage of the existing building. It’s 60% for ground-up construction.

The SBA 504 Loan Program is primarily designed to assist healthy, expanding businesses that have been in operation for more than two years. The following credit requirements apply to such businesses:

- Cash flow from business operations greater than debt service needed to pay existing debt and debt resulting from the proposed loan on a historical or projected basis, and

- Sufficient collateral to secure the loan.

In certain instances, the SBA 504 Loan Program may also be used to finance start-up businesses (i.e. those in operation less than two years). However, such businesses must demonstrate the following:

- Qualified management with industry-related work experience,

- Well constructed business plan.

- Income/expense projections for two years, the first year broken down monthly.

- Access to an adequate amount of working capital, and

- Minimum 15% equity contribution.

Projects involving a single purpose building require a minimum equity contribution of 15% for businesses in operation for more than two years and 20% for businesses in operation two years or less. An example of a single-use building is a bowling center, hotel, assisted living, gas station, and a car wash.

Are you eligible for an SBA 504 Loan?

To be eligible for an SBA 504 Loan, the small business must meet the following eligibility requirements:

- The business must be a for-profit, non-publicly traded company.

- Ownership must be comprised of 51% U.S. citizens or registered aliens with green card.

- The business must do business in the United States or its possessions.

- The business must be a sole proprietorship, partnership, limited liability company, or corporation.

- The business must occupy at least 51% of the space being purchased.

- The business' tangible net worth cannot exceed $15 million.

- The business' average net income after Federal income taxes (excluding carry-over losses) for the two full fiscal years prior to application cannot exceed $5 million.

- Loans cannot be made to businesses engaged in speculation or investment in rental real estate.

- Not all borrowers and uses of loan proceeds meet the SBA eligibility requirements, but if your business satisfies the above requirements, contact us to discuss your specific project.

What’s not eligible to be financed with an SBA 504 loan?

The SBA 504 cannot finance:

- Investment Real Estate

- Rolling stock

- Intangible assets as part of a business acquisition

- Working capital

- Inventory

- Start-up costs

- Marketing/advertising

What can SBA 504 finance?

- The SBA 504 can finance:

- Building purchase or refinance

- Building construction or expansion

- Equipment and furniture (may be included with building financing)

- Large machinery and equipment purchase or refinance

- Leasehold improvements (requires additional collateral or strong borrower)

- Professional costs associated with the building financing (appraisal, environmental report, title work, architect, survey, etc.)

Get Started Today!

Follow our step-by-step process detailing how the loan process works and see if you are eligible.

Benefits of a 504 Loan

- Lower down payment (typically 10%)

- Longer terms and amortizations (no balloon payments)

- Low, fixed interest rate

- Reduces Lender's risk = better terms for the borrower

- Flexible structure: seller note for down payment

- Finance real estate and furniture and equipment into one loan

- Finance soft costs and fees

Industry Examples

Here are some examples of businesses that we have financed:

- Manufacturers

- Large Machinery and Equipment

- Assisted living facilities

- Medical offices

- Professional offices

- Daycare centers

- Retail stores

- Franchises

- Hotels

- Restaurants

- Entertainment

- Self-storage facilities

- Auto repair

- Fitness centers

- Car washes