Small Business Plants Roots in New Home with Boost from SBA

Josh Gershonowicz had a vision. All he needed was an opportunity.

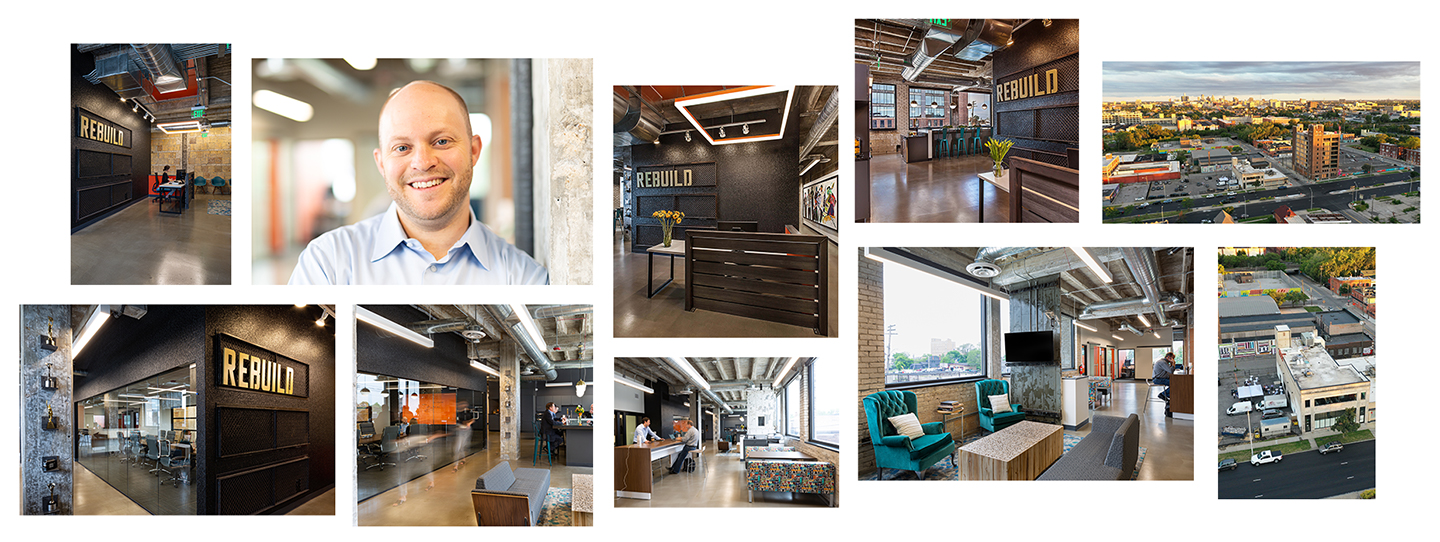

The founder and CEO of Rebuild, a Detroit-based advertising and marketing agency, wanted to move his shop from its New Center location to Milwaukee Junction, a gritty up-and-coming neighborhood that perfectly embodied the company’s entrepreneurial spirit.

He even had a space picked out — the second floor of a 10,000 square-foot building on historic Grand Boulevard, which he would repurpose into a sprawling creative playground. A place where ideas and collaboration could flourish as freely as the neighborhood it inhabited.

“I felt like we had an opportunity to do something different here, something that hadn’t been done for a long time."

“I felt like we could do that here in Milwaukee Junction, especially because of the way we’re positioning ourselves and hopefully bringing jobs back to the city. That’s what it’s all about.”

Vision was never an issue for Gershonowicz. The problem was financing.

Executing his vision would require a significant infusion of capital. And while we had no shortage of lending options, finding the right loan for his business would take some deliberation. After doing some research, he realized that a Small Business Administration (SBA) loan was right for him.

Check out Rebuild Group building footage.

Click button below to see the full video of Josh Gershonowicz’s vision.

Gershonowicz landed with MCDC. He was pleased with the professionalism and expertise of the staff, who walked him through every step of the process and worked with him to structure the loan in a way that satisfied the needs of his business.

In spring of 2019, Gershonowicz walked around his new office, beaming with pride about a vision turned reality. The new home for his company, and its employees, was now open for business.

While Gershonowicz is pleased with his company’s growth, he still sees immense untapped potential. He wants to take Rebuild from a Detroit agency to a national agency based in Detroit.

As he marches toward that goal, Gershonowicz takes comfort in knowing that MCDC will continue to be there to help him realize his vision.

“We’re lucky to have a partner like MCDC that will be there to help us snowplow through hurdles and accelerate our growth.”

Start your story

Tell Us About Your Plans

Answer a few questions about your business in as little as five minutes.

We Match You with Lenders

Receive an email with contact information of lenders who express interest in your loan.

You Talk with Lenders

Decide which lender best suits your needs by comparing rates, terms, fees, and more.

You Apply for a Loan

Submit loan applications! You're well on your way to securing a business loan!